Содержание

Many currency pairs are available for trading, involving several major currencies and also a number of less-well-known, or minor, currencies. The big difference between forex and crypto when it comes to taxes is that forex traders have to choose ahead of time how they want their gains and losses treated, while all crypto trade is treated the same. The tax is figured when you sell the crypto and depends on how long you’ve held the position open. A trade that’s been held for 365 days or less is considered a short-term gain or loss. This short-term gain or loss is payable at the same tax rate as your ordinary income. Periods of sudden volatility lead to extreme price action, which can produce extraordinary profits or losses.

The important point is that this lack of volatility makes it all the more difficult to trade forex. To read more about what moves forex markets and why they move less than other markets, check out this article. This is a huge difference from forex markets, where the exchange rates between currencies hardly move.

Minimizing Trading Risk And Learning Through Experience

Even though Bitcoin has been around for 13 years, acquiring Bitcoin has only become easy to do within the past several years. Score, our system outperforms all compared models and thus proves itself as the least risky model among all. Britannica celebrates the centennial of the Nineteenth Amendment, highlighting suffragists and history-making politicians. Although similar in objective, trading and investing are unique disciplines. Duration, frequency and mechanics are key differences separating the approaches. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

It is essentially 0 rather than absolutely 0 because cash can earn a return if it is deposited with an institution and the terms of a given forex position/account structure will dictate that interest . That is, when holding a currency, if the currency is being held as cash rather than a bond or other interest-bearing instrument, it can only produce a meaningful return via appreciation relative to other currencies. If you took a basket of https://xcritical.com/ every currency in the world , they would yield something close to a 0% real return . In addition to trading 24 hours per day, crypto trades a full seven days per week. First of all, forex is considered as aSection 1256 contractof the IRS tax code. This means that 60% of the gains or losses are counted as long-term capital gains or losses, and the remaining 40% are counted as short-term, regardless of how long you’ve held the trade open.

Investors could also hedge investment risks by staking their assets to earn interest or convert their assets into stablecoin that is pegged to the US currency. Another strategy that involveshedging crypto risksis to perform liquidity assessment by determining the market’s integrity, transaction speed and market fluidity. That’s to allow traders to have quick access to exchanging their assets for cash with minimal exposure to price slippage. Therefore, when large amounts of leverage are used, the market only needs to move a little against the trader’s position to trigger a margin call — which wipes out a significant portion of their trading account.

Many brokers offer this service so traders can get used to the trading and forex market environment. One can greatly reduce counterparty risk by trading with the best forex brokers that are licenced, regulated and reputable. Forex traders also pay only a simple trading fee determined by the spread between currency bid and ask prices, and trading is often governed by simplified tax rules. Finally, traders can pre-determine their stop-loss and trade exit prices prior to entering each trade, meaning they have full control over how much risk they want to take on. Forex trading used to be the exclusive territory of large market operators, but it’s now accessible to the general public and there are many resources available to help beginning traders achieve success.

The tailwind which is present in equities represents more of a cushion against bad performance than a reduced difficulty level in achieving abnormally good performance. IRS rules within the United States treat forex gains and losses differently from crypto gains and losses. In addition, in crypto’s early days, the ability to hold crypto custody on behalf of another party hadn’t yet been worked out. It wasn’t untilMicroStrategy announced its first purchase of Bitcoinin August 2020 that the door opened to corporations who wanted to make cryptocurrencies a part of their treasury plans. In this article, we’ll discuss the similarities and differences between forex and crypto trading. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary and do not constitute investment advice.

It took 12 years to generate the first $1 trillion combined valuations, then another 11 months to add the next $2 trillion. FXCM Markets Limited (“FXCM Markets”) is incorporated in Bermuda as an operating subsidiary within the FXCM group of companies (collectively, the “FXCM Group” or “FXCM”). FXCM Markets is not required to hold any financial services license or authorization in Bermuda to offer its products and services. FXCM is a leading provider of online foreign exchange trading, CFD trading and related services. Trade popular currency pairs and CFDs with Enhanced Execution and no restrictions on stop and limit orders.

Margin

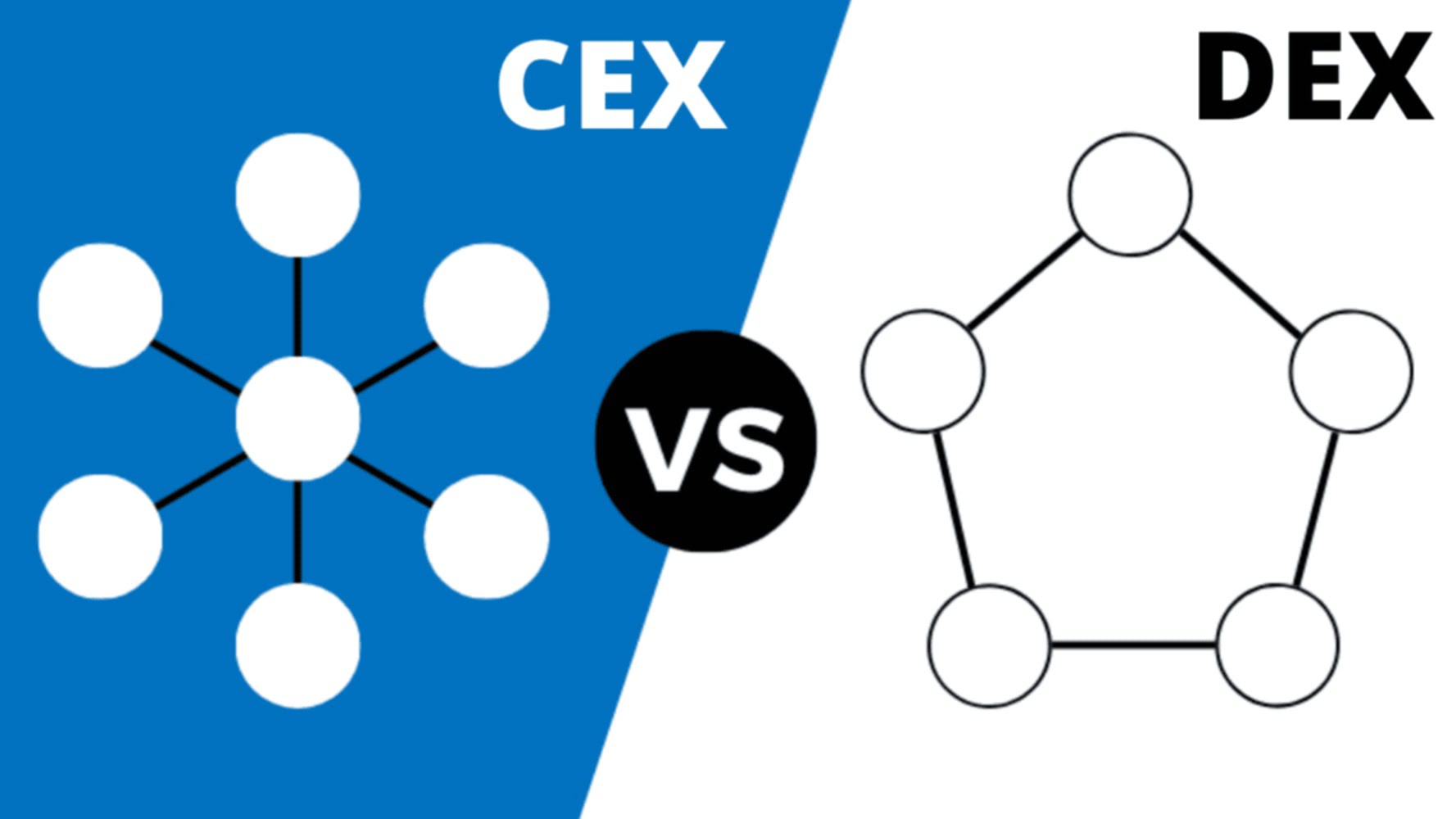

All services and products accessible through the site /markets are provided by FXCM Markets Limited with registered address Clarendon House, 2 Church Street, Hamilton, HM 11, Bermuda. “Position traders” may trade over time frames of one week to a month or more. A managed forex account is a type of forex account in which a money manager trades the account on a client’s behalf for a fee. Market newbies need to become familiar with the lingo specific to that market, the risks they’ll generally be exposed to, and the platforms from which to trade. The main difference between the two is that with aDEXyou have complete control over the private keys to your crypto, while a CEX maintains control over your funds.

Every three years, the Bank for International Settlements estimates the world’s trading volume in foreign exchange. The most recent report came out inSeptember 2019, when BIS found that forex traded $6.6 trillion per day, up from $5.1 trillion three years earlier. Just as cryptocurrencies help fuel various blockchain projects, forex is the fuel for the world’s economies.

The leverage that’s applied to forex is what creates its appeal for traders. The series of contagious currency crises in the 1990s—in Mexico, Brazil, East Asia, and Argentina—again focused policy makers’ minds on the problems of the international monetary system. Moves, albeit limited, were made toward a new international financial architecture. In addition, there were calls for a currency transaction tax, named after Nobel Laureate James Tobin’s proposal, from many civil society nongovernmental organizations as well as some governments. Forex is a fast-moving and accessible market with potential for rewards as well as losses beyond initial investments, even for beginning traders. Forex trading is not more difficult than trading in other markets, but the forex market does present its own particular conditions, behaviour and risks that beginners should be aware of before they start.

Trade your opinion of the world’s largest markets with low spreads and enhanced execution. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Robert Stammer, CFA, is the former director of investor engagement at CFA Institute and writes on thought leadership in the investment management industry.

Largest Companies In The Us By Market Capitalisation

Spot forex traders can opt to be taxed according to Section 988, which treats the gains or losses as ordinary income. A profitable trader will likely see more advantage in choosing the Section 1256 contract route, while a trader taking losses may experience more benefit going the Section 988 route. Crypto trading is the buying and selling of digital assets, such as cryptocurrencies, tokens and NFTs (non-fungible tokens). Forex trading means swapping one fiat currency for another in the hope the currency will rise in value, which the trader can then reconvert for profit.

Definitionally, the zero-sum nature of trading means that only half of all market participants can outperform the entire market. Additionally, brokerage fees and informational asymmetries will reduce the number of fair traders who outperform. That is, the cost of trading eats away at performance and produces a lower net return. Additionally, assuming some number of market participants will always be using material non-public information to their advantage, traders who do not use such information will always be inherently disadvantaged. Given this, it is clear that some number less than 50% of forex traders will outperform the collective market. For beginning traders, both forex and crypto use terms that can be intimidating.

Trading Styles

A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. Although these mistakes can afflict all types of traders and investors, issues inherent in the forex market can significantly increase trading risks. The significant amount of financial leverage afforded forex traders presents additional risks that must be managed. The smaller price movements in forex trading allow dealers to offer deeper levels of liquidity. With the advent of high-speed computing and the decentralized nature of both forex and crypto,arbitrage opportunitiescan exist between two different dealers or exchanges. In arbitrage, a trader will buy at one venue and then sell at another, realizing the difference between the prices at the two venues.

- Whether one buys low and sells high, or sells high and buys low, the mechanism for profiting in the currency markets is relatively straightforward.

- Therefore, financial, rather than trade, flows act as the key determinant of exchange rates; for example, interest rate differentials act as a magnet for yield-driven capital.

- Some forex brokers offer trading over the weekend, but usually, you’re simply transacting against your broker in those situations.

- Before beginning trading, forex traders must decide which route they plan to go, as they cannot change their election afterward.

- The tailwind which is present in equities represents more of a cushion against bad performance than a reduced difficulty level in achieving abnormally good performance.

- Bitcoin and Ethereum are the two primary cryptocurrencies which institutions are gobbling up.

Automated strategies are ideal for institutional and retail traders interested in taking a “hands-off” approach to the currency markets. With automation, there is no need to monitor the forex market in real-time or make split second decisions. All forex trades are executed automatically, independent of human intervention. One of the key attributes of successful forex trading strategies is that they align the trader’s available resources, aptitudes and goals. In doing so, internal conflicts are eliminated from the adopted strategy and harmony is promoted.

Get Your Daily Dose Of Crypto And Trading Info

In the image above, theaverage true range indicator has been applied to the weekly closing prices for the largest cryptocurrency and the most actively traded forex pair (EUR/USD). The ATR has been standardized to determine a volatility percentage, which reflects how far the asset might move in any given week. In this way, trades can be left unattended while the trading account holder is busy with other activities.

How Much Leverage Is Right For You In Forex Trades

That being said, those same traders will want to consider the following information about the market before they start trading forex. Now that the challenging nature of forex trading has been established, it is worth noting that making money trading forex is not impossible, it is simply very difficult. For those who decide to undertake such a venture, consider your time availability, capital availability, and emotional capacity to undergo such a difficult process. Whatever you decide, don’t allow temptation to forex solution lure you into treating the forex market like a casino; either decide to undertake the dedicated research process necessary or don’t participate at all. A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. Factors specific to trading currencies can cause some traders to expect greater investment returns than the market can consistently offer, or to take more risk than they would when trading in other markets.

Generally speaking, less than 10× leverage allows traders enough breathing room to withstand sharp changes in pricing. Demo accounts are great for anyone that wishes to fine-tune their trading skills without putting their money in harm’s way. They offer no-risk market access, which is ideal for those learning forex trading or transitioning to new strategies. One can trade the euro , U.S. dollar , or British pound sterling all without committing any capital to the live market. Without question, the demo account is a powerful tool for enhancing performance.

Market Participants

Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients’ best interests and represent their views without misleading, deceiving, or otherwise impairing the clients’ ability to make informed investment decisions. For more information about the FXCM’s internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms’ Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Bitcoin , Ethereum , Litecoin , Bitcoin Cash and Ripple are leading cryptocurrency products. The forex market lends itself particularly well to automated trading, which is another reason it has attracted a growing number of participants.

The Landscape Of Crypto And Forex Trading

A currency or forex trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. Both forex and crypto dealers’ websites contain beginner-friendly content to help new traders. Look for sections that appeal to beginning traders, or for websites’ education pages. The crypto market was created based on the amount of liquidity being offered by participants at each of the locations. As a result, the crypto exchange you’re using to trade large amounts might not have enough crypto to transact at the time you want to purchase.

Although volatility can be beneficial, it also enhances any trade’s risk profile. Also, in some situations of price volatility, traders may also be exposed to “execution risk,” which occurs when market orders are not able to be filled at exactly the same price that was requested. Depending on their exposure to certain markets, traders may want to hedge those risks by using futures, options or perpetual swaps. For example, a person who earns their income from a smaller coin may want to diversify their crypto exposure into some of the larger cap crypto, such as Bitcoin or Ethereum.

Within crypto markets, the volatile conditions are generally what hurt traders. Forex trades 24 hours per day, 5 days a week, from Monday morning in Wellington, New Zealand to Friday afternoon in New York City. Some forex brokers offer trading over the weekend, but usually, you’re simply transacting against your broker in those situations. If, on the other hand, the crypto has been held for 366 days or more, then it’s considered a long-term gain or loss. Typically, you’ll pay less tax on a long-term gain than on a short-term gain because the rates are generally lower.

Be the first to comment on "Foreign Exchange Market"